Maven Trading Scaling Plan

Exclusive Code 10%: «PROP10»

What Is the Maven Scaling Plan?

The scaling plan at Maven Trading is performance-based. That means you won’t get additional capital automatically just for being active. You have to show results — and maintain them over time.

There are two critical metrics that determine if your account will be eligible for scaling:

- Sustained Profitability – A minimum profit of 10% over a four-month period

- Withdrawal Consistency – At least one payout per month during the same four-month period

Scaling Rules and Growth Structure

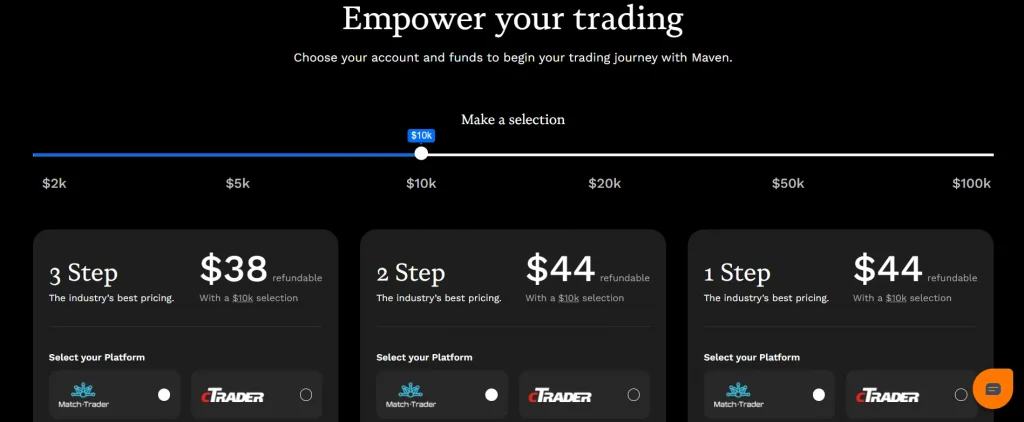

Once eligibility is confirmed, Maven increases the account size by a set margin:

- Scaling Bonus: +25% of current account size

- Repeatability: You can scale multiple times

- Maximum Account Cap: $1,000,000

This growth applies to the simulation account you’re using for payouts. Your payout potential also grows as your balance grows, assuming you maintain rule compliance.

Scaling Timeline Overview

Month | Minimum Requirement | Required Action |

Month 1 | +2.5% profit | 1 payout |

Month 2 | +2.5% profit | 1 payout |

Month 3 | +2.5% profit | 1 payout |

Month 4 | +2.5% profit | 1 payout |

If you miss a payout or fall below 2.5% profit in any month, the timeline resets. It’s a clean structure, but not flexible. Scaling is a reward for both performance and stability.

Conditions That Stay Fixed

Scaling your account doesn’t mean you get to change the rules. The drawdown limits, trade guidelines, and platform controls remain exactly the same. Here’s what remains unchanged:

- Daily Drawdown: Still 2% to 4% depending on the challenge type

- Max Drawdown: Stays at the same percent (e.g., 5% trailing, 8% static)

- Platform Limitations: Only MT5, cTrader, and Match-Trader supported

- News Restrictions: Still in effect during scaling

- Strategy Rules: EA use, hedging, arbitrage bans remain active

What changes is the size of your simulated account and the amount of profit you can withdraw, not the conditions under which you trade.

Scaling and Payout Mechanics

Once scaling is approved:

- The account size increases by 25%

- Payout caps scale proportionally

- Existing equity remains active

- New drawdown levels are recalculated based on the new balance

You do not need to complete a new challenge. There’s no fee. But all previous compliance checks (KYC, payout history, trading rules) are verified again.

Risks and Reset Criteria

Failing to maintain the required profitability or skipping a payout interrupts your scaling eligibility. Here are the conditions that trigger a reset:

- Failing to withdraw in any month

- Closing a month with less than 2.5% net profit

- Breaking any risk management rule

When this happens, your scaling review resets and begins again from Month 1.

How to Track Your Scaling Eligibility

There is no public dashboard for tracking scaling status. Instead, you have to monitor these:

- Your monthly percentage gain

- Your payout activity

- Any rule violation flags

If you meet all conditions, the firm reviews your account manually and approves the scale. There’s no need to apply.

Conclusion

The Maven Trading Scaling Plan is one of the more rule-driven models available. It doesn’t give room for bursts of success. Instead, it builds on slow, consistent results. You need to keep making monthly profit, stay compliant, and withdraw steadily.

That’s a narrow path to follow, but the outcome is structured. If you stick to the plan, your capital access grows, your payout ceilings expand, and your trading leverage scales responsibly within controlled risk limits.

There’s no shortcut. But there is a formula. And that makes it possible.

FAQ:

Your account grows by 25% each time you complete the scaling conditions. You can scale repeatedly until you reach $1,000,000.

No. The system requires a four-month average, with minimum monthly performance and payout activity.

Yes, new drawdown levels are set based on the increased balance, but the percentage thresholds stay the same.