Maven Trading Review

Exclusive Code 10%: «PROP10»

Introduction to Maven Trading

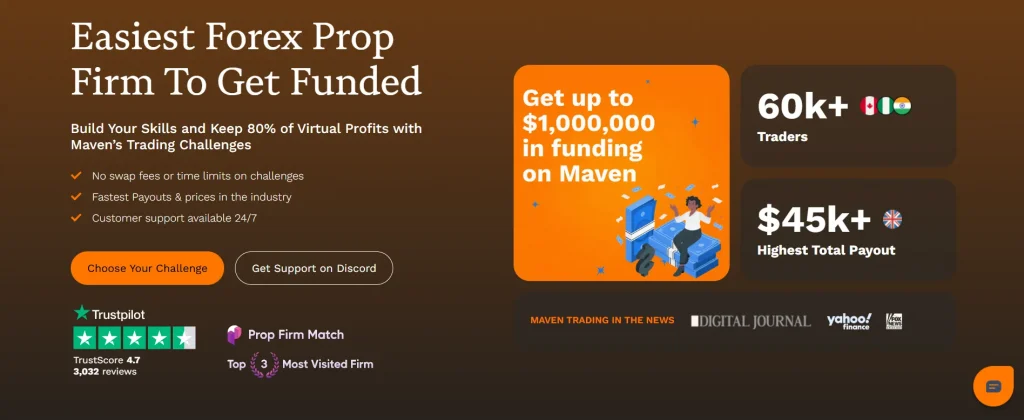

Maven Trading, established in 2022, has rapidly emerged as a prominent proprietary trading firm in the industry. Headquartered in Canada, Maven Trading offers traders the opportunity to access substantial capital through innovative challenge programs. The firm provides a platform for both novice and experienced traders to showcase their skills and potentially manage significant funds. Maven Trading’s commitment to creating a realistic trading environment is evident through its competitive spreads and instant execution capabilities. The firm’s focus on trader success is reinforced by responsive customer support and comprehensive educational resources.

Maven Trading Challenge Programs

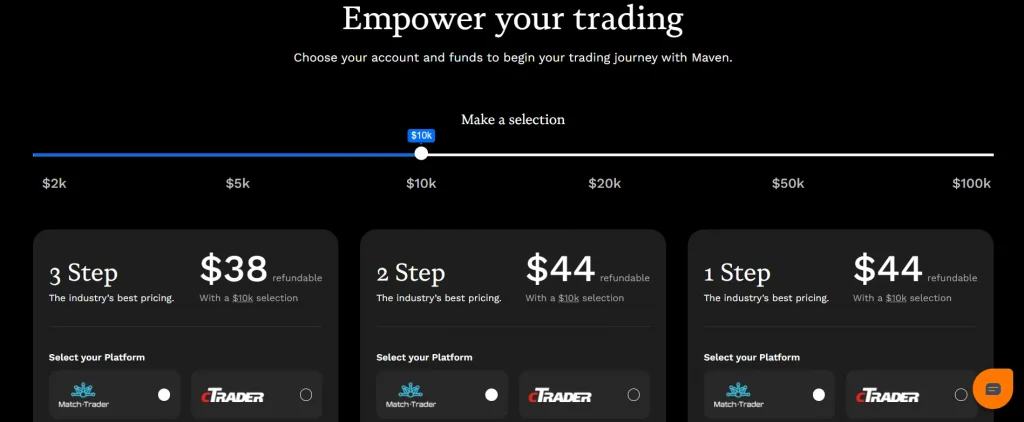

Maven Trading offers two primary challenge programs: Standard and Pro. These programs are designed to evaluate traders’ skills and risk management abilities before granting access to funded accounts. Both challenges are available in 1-step and 2-step formats, catering to different trader preferences and experience levels.

Standard Challenge

The Standard Challenge is ideal for traders looking to start with lower capital requirements. It offers account sizes ranging from $2,000 to $100,000, with challenge fees starting at $15 for the smallest account. The profit target for this challenge is 8%, with a maximum drawdown of 5% for the 1-step challenge and 8% for the 2-step challenge.

Pro Challenge

| Feature | Standard Challenge | Pro Challenge |

| Account Sizes | $2,000 – $100,000 | $2,000 – $100,000 |

| Min. Challenge Fee | $15 | $55 |

| Profit Target | 8% | 8% |

| Max Drawdown (1-step) | 5% | 6% |

| Max Drawdown (2-step) | 8% | 10% |

| Profit Split | 80% | 85% |

Trading Conditions and Instruments

Maven Trading provides traders with access to over 400 tradable instruments, ensuring a diverse range of options for various trading strategies. The available asset classes include:

- Forex pairs

- Commodities and metals

- Stock indices

- Cryptocurrencies

- Individual stocks

Maven Trading offers leverage of up to 75:1 on forex pairs, allowing traders to maximize their potential returns. The firm utilizes the MetaTrader 4 and MetaTrader 5 platforms, providing traders with familiar and powerful tools for analysis and execution. These platforms offer advanced charting capabilities, customizable indicators, and automated trading options through Expert Advisors (EAs).

Payout Structure and Frequency

Maven Trading offers competitive profit splits for funded traders, ensuring that successful participants are well-rewarded for their efforts. The profit-sharing structure is as follows:

- Standard accounts: 80% profit split

- Pro accounts: 85% profit split

Payouts are processed regularly, with Standard account holders eligible for withdrawals every 10 business days and Pro account holders every 5 business days. The minimum profit requirement for withdrawal is 1% of the account balance, ensuring that traders can access their earnings relatively quickly.

Table: Payout Comparison

Account Type | Profit Split | Payout Frequency | Min. Profit for Withdrawal |

Standard | 80% | Every 10 business days | 1% of account balance |

Pro | 85% | Every 5 business days | 1% of account balance |

Trading Rules and Restrictions

Maven Trading has established a set of rules to ensure fair trading practices and maintain the integrity of its funding program. These rules are designed to create a level playing field for all participants while allowing for various trading styles and strategies. Key trading rules include:

- News trading is allowed, but opening new trades or straddling events in a way that leads to significant all-or-nothing wins is prohibited.

- High-frequency trading (HFT) and toxic order flow strategies are not permitted.

- Martingale trading and grid trading are strictly prohibited.

- Expert Advisors (EAs) are allowed, provided they comply with the firm’s rules.

- Maximum lot size restrictions apply, calculated as account size divided by 2.5.

Drawdown Limits

Maven Trading imposes drawdown limits to ensure responsible risk management. For Standard challenges, the maximum daily drawdown is 3%, while Pro challenges allow for a 4% daily drawdown. The overall drawdown limits vary depending on the challenge type and step, ranging from 5% to 10%.

Minimum Trading Days

Unlike some prop firms, Maven Trading does not enforce a minimum number of trading days during the challenge or funded account phases. This flexibility allows traders to adapt their strategies to market conditions without feeling pressured to trade unnecessarily.

Education and Support

Maven Trading provides various educational resources to help traders improve their skills and increase their chances of success. The firm’s commitment to trader development is evident through its comprehensive support offerings:

Market Analysis

Regular market updates and analysis are provided to help traders stay informed about current market conditions and potential trading opportunities. These insights can be valuable for both short-term traders and those taking longer-term positions.Customer Support

Maven Trading offers 24/7 customer support through live chat and a dedicated Discord community. The support team is known for its responsiveness and ability to address technical issues and account-related queries promptly. This level of support ensures that traders can get assistance whenever they need it, regardless of their time zone. Table: Maven Trading Support Channels| Channel | Availability | Response Time | Best For |

| Live Chat | 24/7 | < 5 minutes | Urgent issues |

| Discord | 24/7 | < 30 minutes | Community support |

| Business hours | < 24 hours | Detailed inquiries |

Security and Regulation

While Maven Trading itself is not directly regulated, the firm partners with Blueberry Markets, a regulated forex broker, to ensure a secure trading environment. Blueberry Markets is authorized and regulated by the Australian Securities & Investments Commission (ASIC) and the Securities Commission of The Bahamas, providing an additional layer of security for traders.

FAQ:

Maven Trading’s scaling program allows successful traders to increase their account size over time. Traders who consistently meet profit targets and adhere to risk management rules can potentially scale up to $1,000,000 in funding. The specific criteria for scaling may vary, but it typically involves maintaining consistent profitability over several months.

Yes, Maven Trading allows the use of Expert Advisors (EAs) in both challenge and funded accounts. However, EAs must comply with the firm’s trading rules, including restrictions on high-frequency trading and toxic order flow strategies. Traders may be required to provide their EA code for review if requested.

If you breach the maximum drawdown on a funded account, you have the option to use Maven Trading’s buyback feature. This allows you to regain access to a funded account by paying 60% of your drawdown and successfully completing phase 1 of the challenge again. This unique feature provides traders with a second chance to prove their skills and maintain their funded status.