Maven Trading About Us

Exclusive Code 10%: «PROP10»

Company Background and Legal Framework

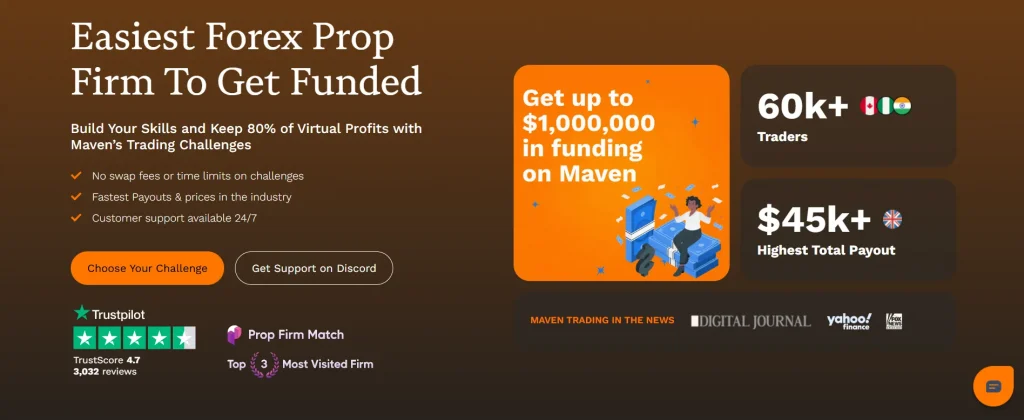

Maven Trading is a proprietary trading company that offers simulated trading accounts to retail traders worldwide. According to the official documentation:

- Registered jurisdiction: Saint Lucia (under international business company regulation)

- Operational base: London, England

- Corporate structure: Operates under Maven Trading Ltd

There are no stated external investors or venture partners. The business appears to be independently operated and funded.

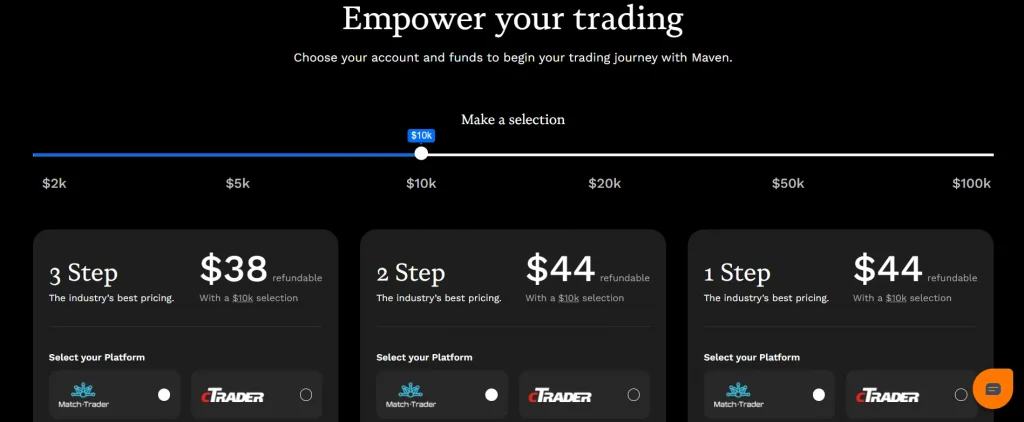

Program Structure: Evaluation and Funded Models

The business model at Maven is challenge-based. That means traders do not deposit capital to trade but instead pay a fee to attempt qualification through predefined trading evaluations.Types of Challenges Offered:

| Challenge Type | Format | Max Drawdown | Payout Model | Refund Eligibility |

| 1-Step Challenge | Single Phase | 5% trailing | Every 10 business days | Yes (after 3 payouts) |

| 2-Step Challenge | Two Phases | 8% static | Same | Yes |

| 3-Step Challenge | Three Phases | 3% static | Same | Yes |

| Instant Funding | No Evaluation | 3% trailing | Immediate access | Yes |

| Maven Mini Challenge | One-day Performance | 3% trailing | Payout within 24 hrs | No |

Profit Split and Withdrawal Terms

Once funded, traders receive 80% of the profits. The firm retains 20%, which it reinvests as balance growth in the same account. There are no tiered splits or volume-based increases.

- Payout frequency: Every 10 business days

- Eligibility: Must complete minimum of 5 active trading days

- Mini Challenge: Paid within 24 hours; no ongoing relationship

The business doesn’t offer profit guarantees. All trades occur in a simulation space. Funded payouts are tied to performance metrics and compliance with rules (drawdown, timing, strategy).

Platform Ecosystem and Tools

Maven Trading provides three platform options:

- MetaTrader 5 (MT5)

- cTrader

- Match-Trader

These platforms are connected to liquidity feeds for pricing simulation. Trades placed in these systems are routed into account tracking software for risk checks, such as:

- Drawdown enforcement

- Payout window validation

- Strategy flagging (e.g., news trading or hedging violations)

There is no support for MetaTrader 4. This limits compatibility with older systems and legacy EAs.

Risk and Strategy Control Infrastructure

Rules are core to the company’s identity. Their enforcement system includes:

- Static or trailing drawdown per challenge

- Daily equity loss caps (2% to 4%)

- 1% max floating PnL loss rule

- Restrictions on arbitrage, hedging, EA use, news event entry

The system is automated. If you breach one of the parameters, your account is disabled immediately.

There is a buyback feature available, which allows traders to regain access to breached accounts for a set fee. This is optional and does not waive the rule violation.

KYC and Compliance Handling

Maven Trading uses Veriff as its identity and AML screening platform. Before any capital is disbursed (even in simulation), traders must:

- Upload government-issued ID

- Submit proof of address

- Pass a biometric match (live photo)

KYC must be completed before first withdrawal or scaling. It’s also used to validate location consistency if an IP or device flag is triggered.

Community and Support Channels

Maven operates a Discord server for public communication. This is the main space for updates, peer discussions, and first-line customer support.

In addition to Discord, support is available by:

- Email

- Phone: +44 7441 445241

The firm does not currently list a physical walk-in office. All support and trading operations are digital.

Conclusion

The Maven Trading About Us section reveals a firm with a clear internal structure and strict risk policies. The company does not operate as a broker or manage external funds. Instead, it runs simulated trading environments where performance is monitored, rules are enforced digitally, and traders are rewarded with controlled access to simulated payouts.

It’s not a flexible model, but it’s a consistent one. If you follow rules and trade cleanly, the system will work. But there are no shortcuts, and no margin for breaking their policies.

FAQ:

Registered in Saint Lucia, operationally based in London, UK.

Payouts are from simulated performance incentives, not pooled client capital.

No. It operates as a proprietary simulation platform under international business status.